are funeral expenses tax deductible in 2020

Funeral expenses arent tax deductible for individuals and theyre only tax exempt for some estates. The IRS deducts qualified medical expenses.

Make Use Of All Those Tax Deductions Germany Has To Offer Sib

You may not deduct funeral expenses on your individual tax returns but there is a way you can save on funeral costs in todays economy.

. The Tax Cuts and Jobs Acts TCJA prohibits individuals estates and. However only estates worth over 1206 million are eligible for these tax deductions. Such amounts for funeral expenses are allowed as deductions from a decedents gross estate as a are actually expended b would be properly allowable out of property subject to claims under the laws of the local jurisdiction and c satisfy the requirements of paragraph c of 202053-1A reasonable expenditure for a tombstone monument or mausoleum or for a burial lot.

No never can funeral expenses be claimed on taxes as a deduction. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. The personal representative may file an amended return Form 1040-X for 2020 claiming the 500 medical expense as a deduction subject to the 75 limit.

Funeral expenses when paid by the decedents estate may be taken as a deduction on a decedents estate tax. Individual taxpayers cannot deduct funeral expenses on their tax return. Funeral and burial expenses are only tax-deductible when paid by the decedents estate and the executor of the estate must file an estate tax return and itemize the expenses in.

The IRS allows deductions for medical expenses to prevent or treat a medical illness or condition but not for funeral or cremation costs. Basic Service Fee of the funeral director. More estates may be eligible for state tax deductions as many states have estate tax exemptions set much lower than the federal government.

The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible.

These are personal expenses and cannot be deducted. Estates worth 1158 million or more need to file federal tax returns and only 13 states require them. In short these expenses are not eligible to be claimed on a 1040 tax form.

For 2019 estates that are under the 114 million threshold do not need to deduct expenses since they are not liable for any estate tax. If someone takes a flight then the amount of money paid for the tickets cannot be written off because travel expenses are not tax-deductible. For most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form.

Ad A Bit of Planning Now Can Keep You From Tax Filing Troubles Next Year. While the IRS allows deductions for medical expenses funeral costs are not included. Individuals cannot deduct funeral expenses on their income tax returns.

Check For the Latest Updates and Resources Throughout The Tax Season. A death benefit is income of either the estate or the beneficiary who receives it. The 300 of expenses incurred in 2021 can be deducted on the final income tax return.

In short these expenses are not eligible to be claimed on a 1040 tax form. While the IRS allows deductions for medical expenses funeral costs are not included. These need to be an itemized list so be sure to track all expenses.

I paid about 14000 for. This is due within nine months of the deceased persons death. IR-2020-217 September 21 2020.

If an insurance policy covered the costs then the funeral expenses cannot be written off either. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. They are never deductible if they are paid by an individual taxpayer.

Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable. Only the estates payments can be written off. In other words funeral expenses are tax deductible if they are covered by an estate.

Can funeral expenses be written off on taxes. Plus the values of estates that have to pay federal or state taxes are very high. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. WASHINGTON The Internal Revenue Service today issued final regulations that provide guidance for decedents estates and non-grantor trusts clarifying that certain deductions of such estates and non-grantor trusts are not miscellaneous itemized deductions. Qualified medical expenses include.

According to Internal Revenue Service guidelines funeral expenses are not deductible on any individual tax return including the decedents final return. The estate itself must also be large enough to accrue tax liability in order to claim the deduction. Deductible medical expenses may include but are not limited to the following.

Can funeral expenses for my mother who was 96 years young and on Medicare and Medicaid such as pre-plan funeral costs and a monument be deducted on my 2020 taxes. For this reason most cant claim tax deductions. IRS rules dictate that all estates worth more than 1158 million in the 2020 tax year are required to pay federal taxes at which point they can take advantage of tax deductions on the funeral expenses of a loved one.

Individual taxpayers cannot deduct funeral expenses on their tax return. If the beneficiary received the death benefit see line 13000 in the Federal Income Tax and Benefit Guide. Call Final Expense Direct at 1-877-674-0236 if you have.

Funeral expenses are not tax deductible because they are not qualified medical expenses. According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased persons estate. You may not take funeral expenses as a deduction on a personal income tax return.

Placement of the cremains in a cremation urn. That depends on who received the death benefit. Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs.

Qualified medical expenses must be used to prevent or treat a medical illness or condition. Schedule J of this form is for funeral expenses. Qualified medical expenses must be used to prevent or treat a medical illness or condition.

These expenses may include. Funeral expenses are not tax-deductible.

Make Use Of All Those Tax Deductions Germany Has To Offer Sib

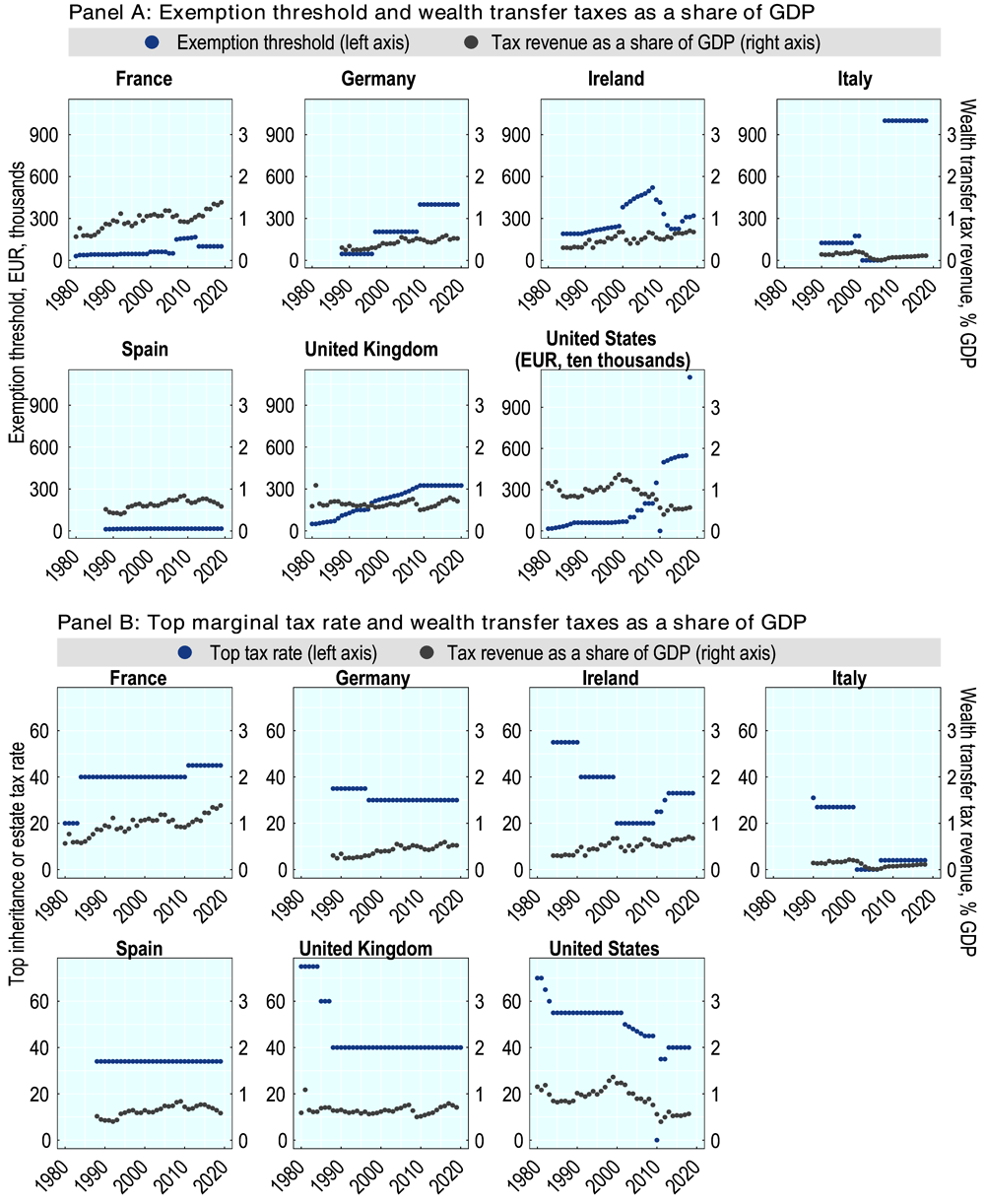

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Tax Return 2017 File Now And Get Back From Taxes Taxfix

Tax Return 2017 File Now And Get Back From Taxes Taxfix

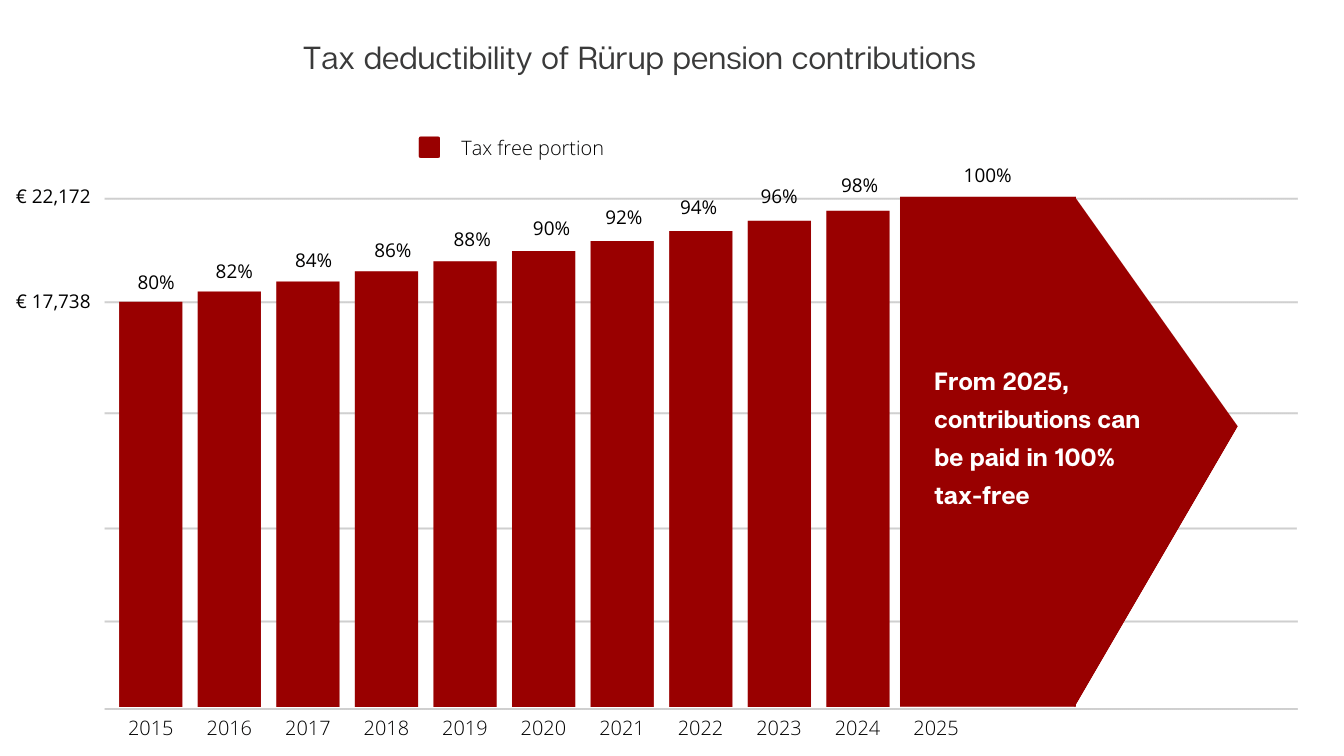

Rurup Pension In Germany For Employees Self Employed

Tax Deductions In Italy Financial Advice In Rome Italy

Make Use Of All Those Tax Deductions Germany Has To Offer Sib

Taxing The Digitalization Of The Economy The Two Pillar Approach By Bundesverband Der Deutschen Industrie E V Issuu

How To Handle Medical Expenses Including Marijuana On Your Tax Return Oregonlive Com

Tax Return Germany 49 Deductible Expenses In 2021 Germansuperfast

Report International Conference On Inclusive Insurance 2020 Digital Edition